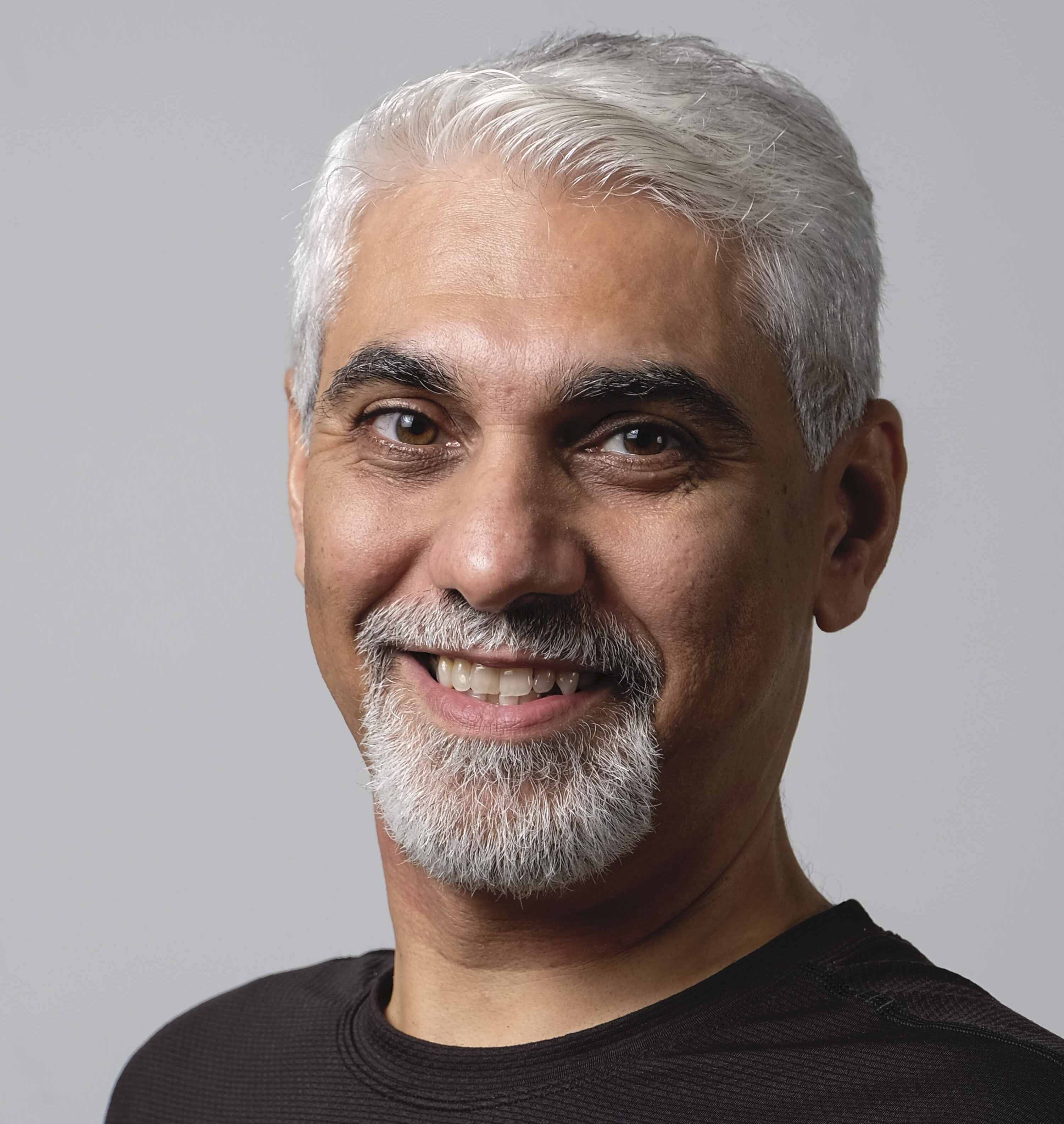

AHMED BASTAWY

Renowned Managing Director, International Speaker, and Impact & Innovation Consultant

Ahmed Bastawy is a dynamic and highly accomplished professional with over 15 years of expertise in innovation consulting, program design, and facilitation. As the Founder and Managing Director of ICEALEX Innovation Hub (Egypt), iceHubs LLC (USA) and a Board Member at AfriLabs (Africa), Ahmed leads the charge in fostering innovation and providing vital support to emerging businesses and startups on the African and global scale.

At the heart of his entrepreneurial journey lies the success story of Startups of Alex, the first business incubator in Alexandria, which Ahmed established to nurture impact-driven entrepreneurship. His extensive experience and remarkable skills have made him an invaluable asset, particularly in the domains of innovation, entrepreneurship, and management consulting.

During his tenure as the International Business Development Manager and Cofounder at iceHubs Global CIC, a renowned UK-based social enterprise, Ahmed played a pivotal role in transforming sustainability challenges into sustainable, green business solutions. His international reach extends across 18 countries in Africa, Southeast Asia, and Europe, where he has provided consultancy and mentorship to international organizations, startups, and impact ventures.

Ahmed Bastawy boasts a diverse and impressive skill set, encompassing incubation and acceleration program design, human-centered design, and the facilitation of purpose-driven innovation. His distinguished track record is marked by a series of measurable successes, consistently driving growth and innovation across various industries.

Beyond his consultancy roles, Ahmed has made substantial contributions to the field, including co-authoring the acclaimed book "Social Innovation Handbook for Practitioners: Innovating Ideas for the Labor Market in Egypt." His published research, with a focus on the MENA region, underscores his commitment to advancing knowledge and innovation.

In his role as a consultant, Ahmed has spearheaded comprehensive market analyses and provided invaluable subject matter expertise in entrepreneurship, innovation, and circular transformation in the region. His leadership has been instrumental in organizing multinational conferences and serving as a lead trainer and content developer for entrepreneurship boot camps, design thinking workshops, and digital innovation competitions.

As a renowned and sought-after speaker, Mr. Bastawy has graced prestigious stages worldwide, delivering impactful presentations at prominent events such as Re:publica Berlin, Social Enterprise World Forum, Smart Cities World Congress Barcelona, the Egypt Entrepreneurship Summit, CeBIT Hannover, and the RiseUp Summit.

Ahmed Bastawy is an active participant in the global innovation community, aligning himself with esteemed networks such as the Global Innovation Gathering, AfriLabs network, and Fablab networks. His passionate advocacy for impact investing and the transition toward a circular economy has led to his co-founding of an Impact Investing Initiative.

With a Master's in Business Administration, specialized in Entrepreneurship from UCAM Universidad Católica San Antonio de Murcia in Spain, Ahmed seamlessly blends his engineering background—holding a specialized master's diploma and bachelor's degree in Mechanical Engineering from Alexandria University—into a unique perspective that bridges innovation and business acumen.

His impressive credentials also include certifications as a Certified Enterprise Design Thinking Practitioner by IBM, a Certified Corporate Governance Professional from the Egyptian Financial Regulatory Authority (FRA), and a Certified Circular Businesses & Sustainability Trainer and Coach from international institut